One of the most frequent questions I’ve been asked ever since I’ve been advising PSS clients, is ‘what is my retirement actually going to look like compared to my current take-home pay today?’.

In this particular example, we’ve got a new fictitious person called Anne. Now Anne has contacted me and said she wanted to retire in 2030. It’s currently 2023 and she is a PSS contributing member. We were able to ascertain that her current IBM as of 2023 is 3.1. We can then determine what her ABM is going to be in 2030 based on the fact that she is doing 10% contributions, she has been there more than 10 years and she is in full-time employment.

So, we managed to ascertain that her ABM is going to be 6.51, her final average salary will be $106,500.

How PSS contributions actually work

This is going to give Anne a retirement benefit of $693,550 in 2030. Based on her being sixty years of age, this will provide her a gross pension of $63,050 or $2,425 per fortnight. This is however gross. We now do need to work out the net take-home figure.

So with Anne’s PSS pension of $2,425 per fortnight, we’ve managed to ascertain that her components are likely to be 19.5% tax free, 32% tax taxable and 48.5% untaxed.

Because she is 60 years of age, the only component that has tax, is the untaxed component and that gets a rebate of 10%.

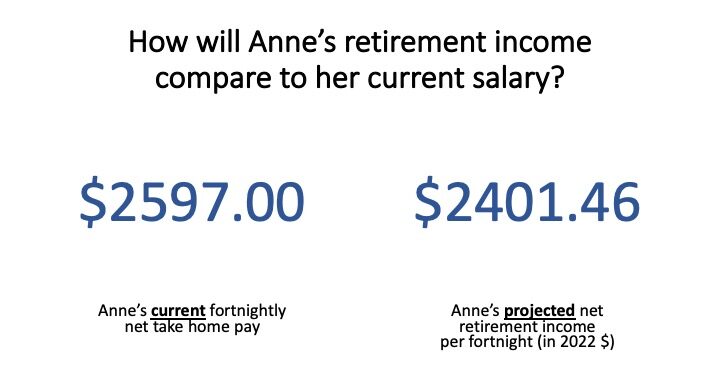

How will my retirement income compare to my current salary?

Anne currently nets $2,597 dollars per fortnight so that’s what she’s taking home. We have been able to project that her PSS take-home pay at age sixty is likely to be $2,401.46 per fortnight.

We’ve been able to project forward the ABM accurately, the final average salary fairly accurately and then we’ve used today’s tax rates. Obviously, the tax rates may change. However importantly we have projected this in 2023 dollars as opposed to future dollars.

You can see that from here we’re able to ascertain fairly quickly that there’s about a $200 per fortnight difference between working and being retired.

That’s a pretty powerful situation for people to be able to lock down and it does go a very long way to removing the retirement anxiety that we come across so often.

This is why the PSS health check was developed. The intention of the PSS health check is to provide this information to an individual at a set point in time ie from 55 onwards. So in Anne’s case we used age 60 though. Everyone will have their own pre planned retirement date and that’s the date we’ll use in your individual PSS health check.

If you would like to book for a personalised PSS health check at a predetermined point in time with Cameron Teague, our Certified Financial Planner, book now on the link below.