Are you wondering how the contribution process works? There is a great deal of confusion from PSS members.

It’s now 2023, Jayne is an EL1 and she has a super salary of $108,000 per annum. Jayne has elected to contribute 10% of her super salary to her PSS each year.

How PSS contributions actually work

There are basically four different contributions that make their way into your fund.

The first contribution is the employer compulsory 8%. This is often referred to as the unfunded contribution. In addition to this there is a 3% productivity contribution which is often referred to as the EPS.

In addition to this there is the member voluntary contribution. Now this can be up to a maximum of 10% and it must be a post-tax contribution from the member.

In addition to this the employer will then match the member contribution up to 10% depending on the service period. If you’ve been there for longer than 10 years they will match up to 10%. If less than 10 years they will match up to a maximum of 5% only.

What this means in total is if you’ve been here less than 10 years, you’ll get the 8% plus the 3%, plus the 10%, plus the 5%, giving a 26% or 0.26 ABM.

If you’ve been there greater than 10 years you will get the 8%, plus the 3%, plus the 10%, plus the 10%, giving you a total of 31% or 0.31 accrued benefit multiple.

Accrued Benefit Multiples

Accrued benefit multiples are very important and are quite complicated.

In Jayne’s particular circumstance, we already know that she’s been any greater than 10 years and we know that she’s contributing 10%.

So Jayne’s going to get the 8%, plus the 3%, plus the 10%, plus the 10%. That totals 31%. Now this in total equates to a contribution of thirty three thousand four hundred and eighty dollars per year.

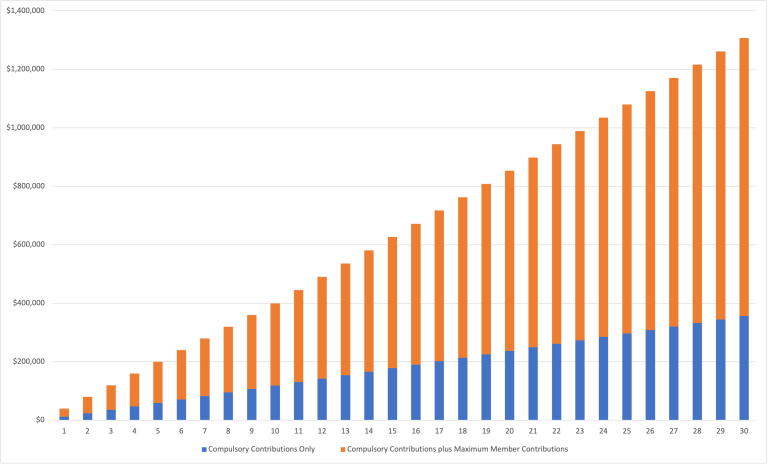

Let’s look at the impact of the different level of contributions that Jayne is able to make.

We know that the employer compulsory contribution is 11% in all circumstances. That’s $11,880. If Jayne elects to contribute nothing then the employer will also elect to contribute nothing.

This will mean that the total contributions per annum for Jayne will be $11,880 which is the employer compulsory component.

If Jayne elects to contribute 5%, then the employer will also elect to match that 5%. This will give us a total per annum of $22, 680.

If Jayne however elects to contribute the maximum 10%, the employer will again match that ten percent. This will give us the greatest outcome for Jayne which will be a total per annum of $33,480.

On the graph below, you can see that the orange line is the maximum contribution. The blue line is the employer compulsory contribution.

As you can see there is nearly three times the benefit from doing those additional contributions into PSS.

If you have PSS super, you have an amazing opportunity with this powerful inbuilt matching feature.

You have a VERY important decision on how much you would like to contribute.

Here we have focused on the contribution amounts as opposed to the accrued benefit multiple.

This is general advice as everyone has a unique set of circumstances which means there is no one-size-fits-all. If you would like to get personal advice, we are more than happy to do that.